With decades of combined experience in venture capital, go-to-market strategy, and private and government commercialisation, we bring practical expertise in early-stage across all industries.

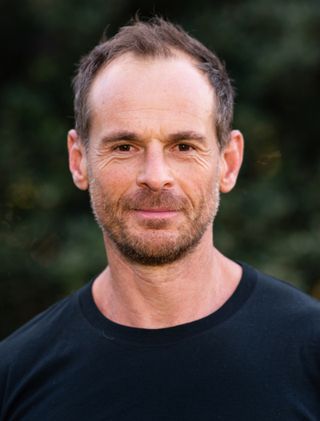

Dan Bennett

Founding Partner

“My passion is cultivating human curiosity and backing innovators who push us beyond the reasonable. Sometimes, in order to be a realist, we must believe in miracles. ”

Marten Peck

Founding Partner

“I have a strong passion for connecting those at the leading-edge of innovation with the right network and resources. Supporting visionary entrepreneurs and their start-ups, as they create new technologies that will shape our collective future, is truly exhilarating.”

Stephane Janson

Investment Team

“There are few things as exciting as sitting alongside a founder, and feeling myself being drawn into their vision, slowly falling in love with their ambition, and mapping out why they will achieve it. I want to back and support innovative founders, disrupting old and inefficient industries, with fresh and daring ideas.”

Nina Hooper

Investment Team

“I love helping highly technical founders identify, translate and articulate the specific critical value they add to customers. I believe that the only way to bring an ambitious vision into reality is a go-to-market strategy that is grounded in a deep understanding of the specific industry’s motivations and challenges.”

Archie Judd

Investment Team

“I’m passionate about supporting visionary founders who are pushing the boundaries of what’s possible in science and technology. “If I have seen further, it is by standing on the shoulders of giants”; my mission is to support the next generation of companies that are creating the building blocks of humanity’s future.”

Will Lee

Investment Team

-320x320.jpg)

“Our world is built by long-term optimists with a bias to action. I feel privileged to spend every day supporting founders, pouring energy to advance their wildest ambitions – “Most people think improbable ideas are unimportant; but the only thing that’s important is something that’s improbable””

Tim Baker

Finance Team

“I enjoy leaning in to support fund operations and compliance. It brings me great satisfaction to manage complex needs and requirements for funds as they grow.”

Sarah Poulos

Finance Team

“I’m a highly commercial and technical professional and thoroughly enjoy helping businesses achieve their growth ambitions.”

Sarah Poulos

Finance Team

“I’m a highly commercial and technical professional and thoroughly enjoy helping businesses achieve their growth ambitions.”

Supported by leading Strategic Advisors

Dan was a crucial investor and mentor. He worked tirelessly to help ensure our success, with deep insights on strategy, growth and introductions. Without his support early on, we would've found the capital raising journey very hard to navigate.

Co-Founder & COO, Instaclustr

Join our mission

We move fast to provide patient capital